Sole Proprietorship Firm Registration

Sole proprietorship registration is one of the oldest and easiest business to start in India. It is the most convenient and simplified way to commence a sole proprietorship business. There is no legal difference between the business and the owner in a sole proprietorship business. Since Sole Proprietorship business firm Registration Online in India isn’t governed by any specific laws and rules and regulations, it is the easiest form of business to operate. Register proprietorship firm online through IVEC.in

- Funds Raising

- Easiest Business Structure

- Decision Making

- Easy Management

- Call Us : +91 94 35 41 32 37

Complete Info About Sole Proprietorship Firm

Sole Proprietorship Firm Registration is Single Person Firm Registration. Registering a Proprietorship firm in India requires no formalities or registration. There is nothing as proprietorship registration on paper. Documents Required for Sole Proprietorship Registration in India. Easily register a sole proprietorship online with IVEC.in.

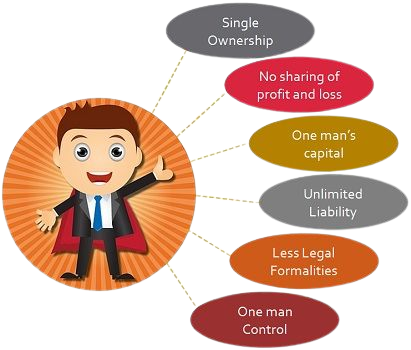

When a business is managed and owned by one single person, it is called a sole proprietorship company. This type of business structure can be incorporated in fifteen days and therefore makes it one of the most preferred types of business structures to start in the unsystematic sector, especially among small traders and merchants. Generally, registration is not required for a Proprietorship firm business, as it is distinguished through alternate government business-related registrations, such as GST registrations. Additionally, its liability has no limit, hence it doesn’t hold perpetual existence.

In a sole proprietorship business structure, there is no legal difference between the business and the owner. To make it clear, a sole proprietorship is not a legal entity. The owner of the business is completely responsible for clearing off all the debts and loans of the business. The Sole Proprietorship Registration in India is one of the preferable and popular forms of business in India. It is simple and easy to start that too at a nominal cost.

A single proprietorship is a simplified and most convenient way to start a business in India. It is neither considered as a company nor a corporation and the business is owned and controlled by an individual who is the owner, director, member and shareholder of the proposed entity. Some of the common examples of proprietorship business are shops like grocery, chemist, saloons, and so on.

A sole proprietorship is a simplified and most convenient way to start a business in India. It is neither considered as a company nor a corporation and the business is owned and controlled by an individual who is the owner, director, member and shareholder of the proposed entity. Some of the common examples of proprietorship business are shops like grocery, chemist, saloons, and so on.

An individual who wants to start his own business can form and run their business as a sole proprietor and can enjoy the complete rights and responsibility of his business. As per the Income Tax Act, the loss or profit of the Sole Proprietorship is considered as the loss or profit of the owner and the income that gained from the Sole Proprietorship is considered as the income of the owner of the business. Most of the entrepreneurs believe that individual Sole Proprietor as an ideal business entity and have incorporated their business under it.

- The scanned copy of the aadhar card of the proposed proprietor of the sole proprietorship accounting. Aadhar card is necessary to register any business structure in India.

- In addition to the Aadhar card, the PAN card of the proposed proprietor is also a mandatory document for a proprietorship business registration in India.

- With a PAN card and Aadhar card, the proprietor of the business entity is liable to open a bank account in the name of his sole proprietorship firm.

- Along with the above-mentioned documents, the individual would require identity proof and address proof for the registration process.

- Documents needed for GST registration are also required to open a current bank account in the name of the company.

- A proprietor of the sole tradership firm can run his business activities at any rented place or owner place. The individual has to submit some of the proof of his registered office, documents such as:

- If the registered office is owned property, any utility bill is required such as electricity bill, water bill, gas bill, etc. with the No Objection Certificate. The bill submitted should not be older than two months

- If the registered office is rented property, then a lease/ rent agreement of the rented property along with the NOC from the owner is required.

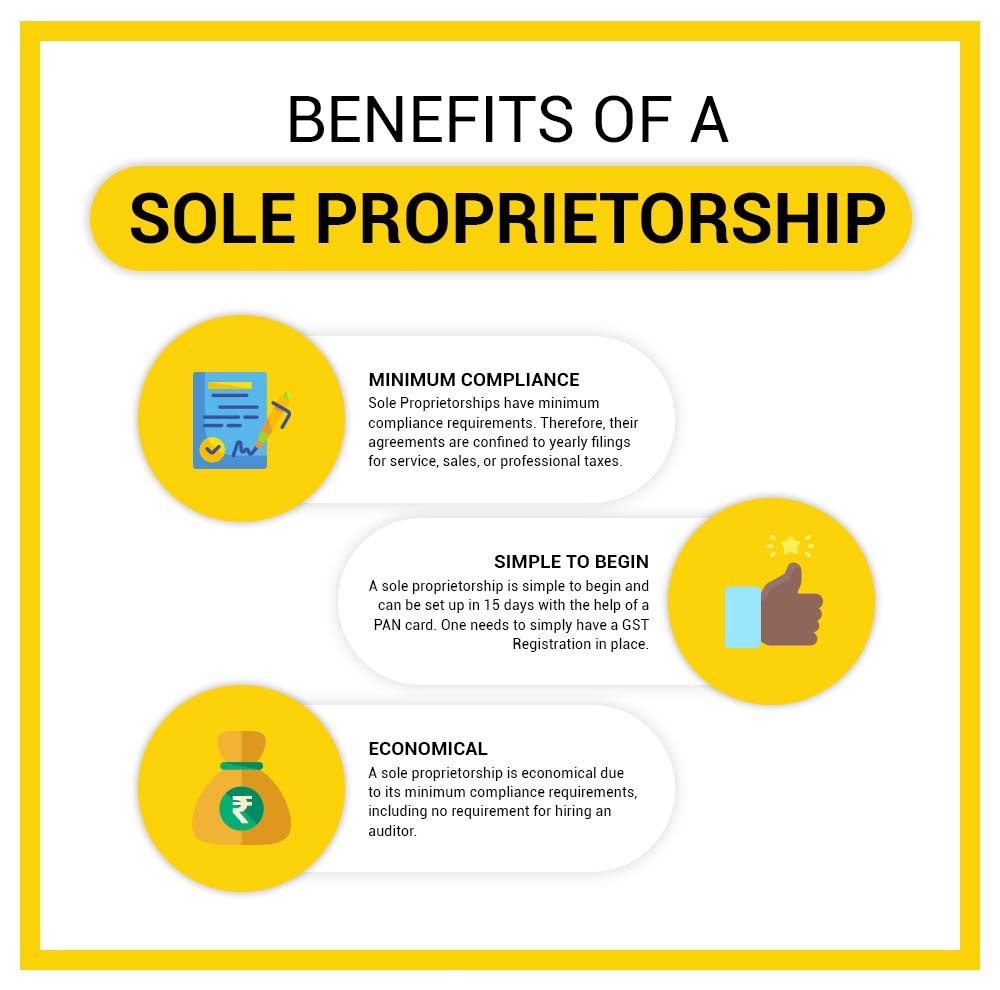

Each and every business structure has its own advantages. Likewise, some of the advantages of a Sole Proprietorship Business mention below:

Individual’s Investment:

To form a sole trader company, an individual who wishes to start this type of entity has to invest his personal assets or should get money from other financial resources such as bank loan, borrowing money or lending loan.

No Sharing Of Profit Or Loss:

All the income gained or the loss or debt obtained by the Sole Proprietorship Business belongs to the owner of the entity, and he/she is not allowed to share it with someone else.

Ownership:

An individual person holds the complete power of the entire business and that person is the owner of the firm. Later, that individual can transfer the ownership of the business through a will or as his last testament.

Fewer Formalities:

With the ease of beginning, a sole proprietorship company firm comes with a few rules, formalities and regulations before and after the registration process.

Unlimited Liabilities:

This feature of this business structure sometimes acts as a flaw. Since the business and the owner of the business have no separate identity, even the personal property of the owner can be used to repay all the debts and loans that happened because of this business.

Control Power

The control power of the entire business is in the hands of a single person or the owner, and he/she don’t have to answer anyone else. The individual who is the owner of this business should be capable of using his intelligence, expertise, skills and hard-working to run all the business activities.

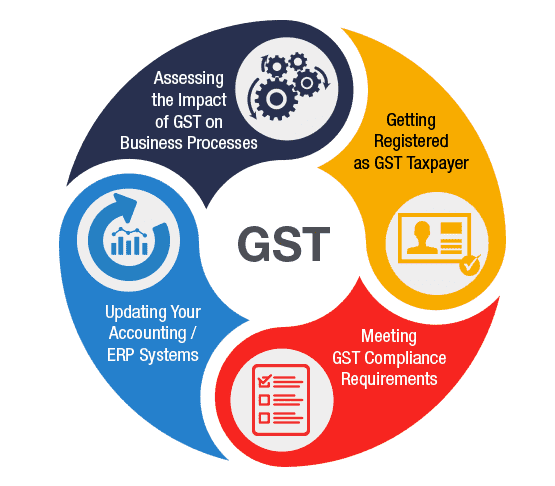

A proposed person can choose any of the below mentioned options for the sole proprietorship registration online in India process:

- SME Registration process

- GST registration process

- Registration as per the Shop and Establishment Act under the rules and regulations of that particular state

SME Registration Process for Sole Proprietorship Firm

As per the provisions of the MSME Act, any person requires registering as an SME (small and medium enterprise) to start a business. To complete setting up a sole proprietorship, the individual has to submit an online application. However, this is compulsory but is good for the company, as it can be used during the need of loan requirement at a low-interest rate. The government has also introduced many schemes for the improvisation of SMEs registered as per the MSME act.

Shop And Establishment Registration

To register in the Shop and Establishment registration process, the person must own a shop and it is issued by the municipal parties depending on the number of workers or employees in the firm.

GST Registration

Getting a GST registration is mandatory to run any type of business activities in India. GST number is necessary even if the individual is doing online business. GST registration takes about 5 working days and it requires the following documents:

- PAN Card and Aadhar Card of the proprietor

- Passport size photographs of the proprietor

- Office proof

- Bank Statement copy with the bank account number, branch address and IFSC code

Post Compliances

- Should file annual Income Tax returns within the due date.

- Should file GST if the business is registered under GST registration

- If the sole trader firm is liable for TAX audits, then the proprietor should deduct TDS (tax deducted at source) from workers income and should file TDS returns

Who can start a sole proprietorship business structure?

Any Individual who is a resident of India can form a sole proprietorship. All the person needs is to open a current bank account in the name of your business. The procedure of Registration depends on the type of a business you are going to start up.

How long will it take to form a proprietorship?

Usually, it takes about 15 days, not more than that. This is one of the main reasons for the popularity of proprietorship business form among traders and merchants.

What kind of business can be sole proprietorships?

Businesses such as grocery stores, small traders, manufacturing businesses and fast food vendors are some of the common sole proprietorships. Even though, bigger businesses can also be sole proprietorship but it is not recommendable as it holds unlimited liability and single had business.

What sort of papers does a person need to open a current account in the proprietorship name?

Copy of Shops & Establishment Act Registrations along with PAN card, identity proofs, proof of your company’s existence and address.

Are any of these registrations can be done online?

Registrations such as Service Tax and any of the registrations regulated by the central government are done online. Nevertheless, state-government registrations might not be usable online.

What are the benefits of a sole proprietorship firm?

Least complex and the cheapest form of the business form are some of the main advantages of this kind of firm.

What are the other requirements needed along with a current bank account?

Along with a current bank account, you need GST Registration if your business turnover exceeds the limit as dictated by the government.

Can I convert Sole Proprietorship Firm business to a Private Limited Company?

Yes, you can convert the Sole Proprietorship Firm to a Private Limited Company anytime you want as per the rules and regulations of the government.

What are the requirements needed to start a Sole Proprietorship Firm?

Name and a place for your business are only two basic requirements to start a Sole Proprietorship Firm.

Why Choose Sole Proprietorship Firm?

Choose IVEC, Be Smart.

Access To Experts

We provide access to reliable professionals and coordinate with them to fulfill all your legal requirements. You can also track the progress on our online platform, at all times.

Realistic Expectations

By handling all the paperwork, we ensure a seamless interactive process with the government. We provide clarity on the incorporation process to set realistic expectations.

300-Strong Team

With a team of over 300 experienced business advisors and legal professionals, you are just a phone call away from the best in legal services.

Trusted By Thousand Of People.

Book Your Consultation Now

We’re Trusted By 1000’s Of People Since 2008 🙂 We are a technology-driven platform, offering services that cover the legal needs of startups and established businesses. Some of our services include incorporation, government registrations & filings, accounting, documentation and annual compliances. In addition, we offer a wide range of services to individuals, such as property agreements and tax filings. Our mission is to provide one-click access to individuals and businesses for all their legal and professional needs.

Why Choose IVEC?

No more delays or difficulties! Register your business with India’s #1 provider of company incorporation services. Get a 7 day . Guaranteed document upload to the MCA

Get Set Go!

Our company registration process is completely online, so you don’t even have to leave your home to get your entity registered.