Trust Registration

Trust registration in India begins with the drafting of a trust deed as it is the first requirement in the trust registration online procedure. Trust Deed is the mandatory document to register a charitable trust and that is the reason why charitable registration is also called a trust deed registration. As per the Indian Trust Act 1882, the Trust is an organization where the owner (trustor) determines to transfer the power and right of his asset to a second person called trustee so that the beneficiary can enjoy the benefit out of it.

- Call Us : +91 94 35 41 32 37

Complete Info

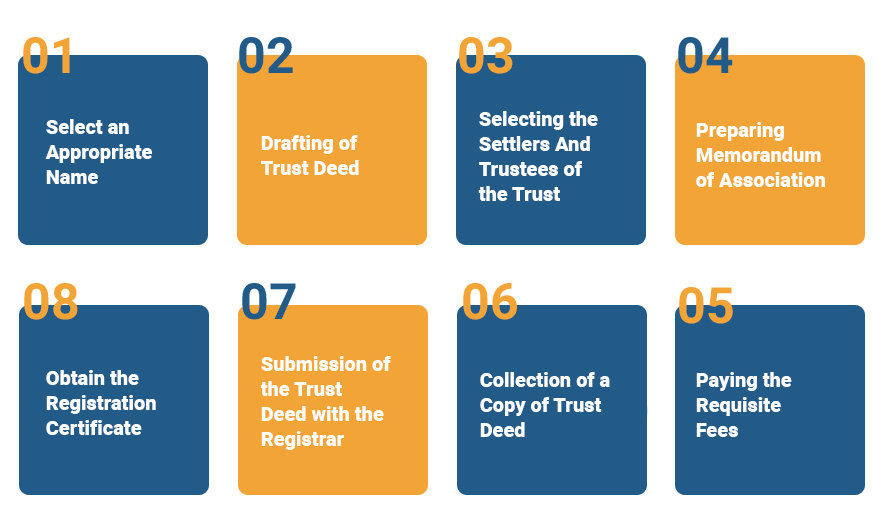

Trust registration starts with the preparing of a trust deed as it is the first step or requirement in the trust registration online procedure. Trust Deed is mandatory to register a charitable trust. Therefore, charitable enrolment is also called a trust deed. Trust Deed is usually drafted on the non-judicial stamp document, every state has determined its own price on stamp duty. Once the drafting of Trust deed registration is done, the very next step is to book an appointment with the concerned sub-registrar office. And importantly, all the trustees have to present on the appointment date with the sub-registrar along with the trust deed and two witnesses to carry on the registration process.

What is a Trust?

As per Indian Trust Act 1882, the Trust is an organization in which the owner or trustor adjudicates to transfer the power and right of his property or asset to a second person named trustee which means that the third person or beneficiary can get the benefit out of it.

Such an asset or property is transferred by the trust register to the trustee with the declaration of the statement that the trustee should own the asset or property for the recipients of the Trust.

Categories Of Trust

Public Trust

This type of trust is created to furnish benefit to the public in a vast level, therefore the beneficiaries in the type of national trust registration are the general public. Public Trust is further classified into two parts:

1. Public Charitable Trust

2. Public Religious Trust

Private Trust

In this type of private trust registration mostly the family members or individuals are the beneficiaries. A private trust is further classified into two parts:

1. Private Trusts in which the recipients and their imperative offers also can be settled

2. Private Trusts in which both or either the recipients and their imperative offers can’t be settled

The purpose behind starting any trust is to work on charitable activities and at the same point, you can enjoy the advantage of tax exemption. These charitable trusts are otherwise known as a non-profit organization.

Trust gains the legal entity and it can avail all the benefits offered of the trust by the government. Trust Act and Federal laws make it essential for such companies to get registered as per Charitable Trust.

The Departments of Federal and State Law in India provide an assortment of assets to handle and regulate the charitable associations and the common public. This procedure greatly helps those donators who are willing to donate their property and assets to the trusts, by making them trustees which helps in tax benefits.

During the charitable trust registration, it is mandatory that you have to understand and know some fundamental knowledge which is related to trust company registration and the amount of fee at the time of the enrollment process. Explicit laws such as the Trust Act 1882 have been announced, and application form has been certified and endorsed to recommend the procedure of registration.

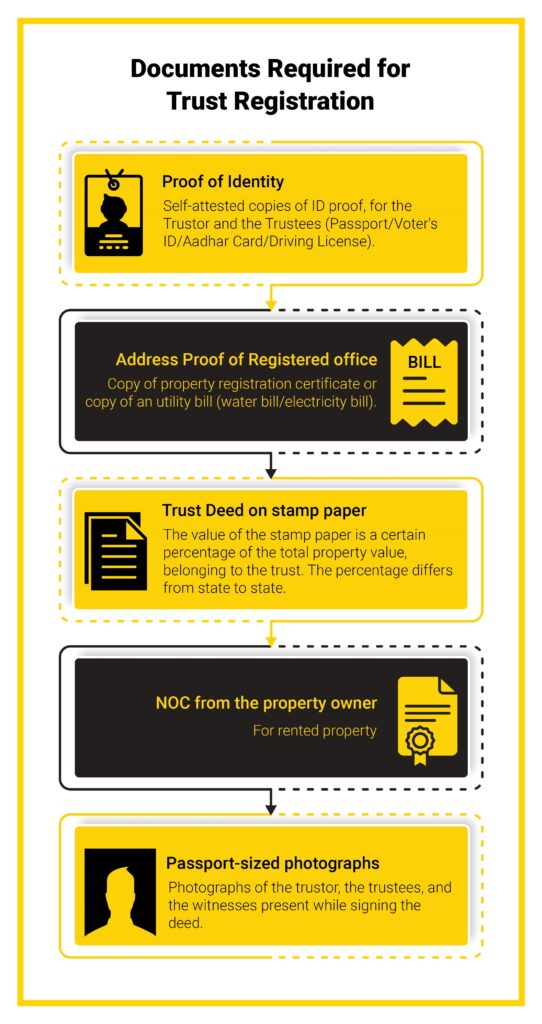

For the trust registration under ‘The Indian Trust Act, 1882”, the following documents are mandatory:

A bill of water or electricity mentioning the address which needs to be registered.

The identity proof of minimum of two members of the entity. The identify proof can be:

Driving License

Voter ID

Aadhaar Card

Passport

After paying the fee for the registration process, it takes around 8 to 10 days for online trust registration as per the norms of the Indian Trust Act – 1882.

Before the legal document becomes valid all around the country, the applicant has to submit a presentation at the corresponding registrar’s office.

- Step 1:

Fill the NGO Registration Form, the applicant has to fill all the needed details in the simple application form.

- Step 2:

Assemble the Prerequisites details, here you have to collect all the required documents as per the specifications. And it takes around 2 working days

- Step 3:

Compile a trust deed, as per the documents provided by you for the registration process, a Trust deed will be compiled. This process will take around 4 to 5 working days

- Step 4:

Trust Deed Registration process, the trust deed so compiled will be presented to the concerned local registrar for registration. It takes around 12-13 working days to complete this process.

- Step 5:

Trust NGO registration certificate is granted. Once your Trust NGO Registration process got completed, you will receive the registered Trust Deed through courier.

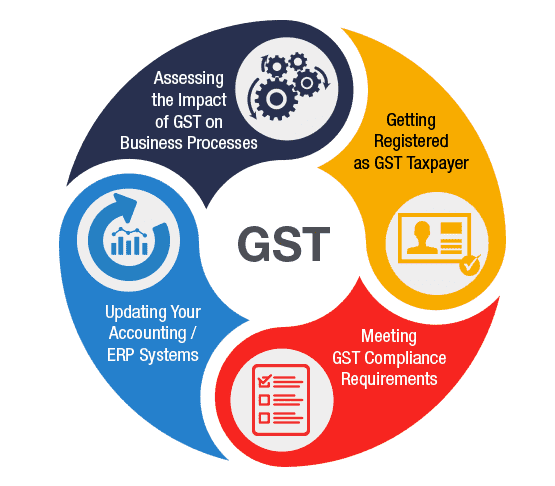

Income Tax Formalities

After completing a valid trust registration, the very next step is to follow the 12A and 80G registration which make you eligible to avail the benefit of tax exemption. To file an application for the registration, Form 10A is used.

The total payment fee of the trust or establishment without providing impact to the provisions of Section 11 and 12 exceeds 50,000/ – every year, the report and statement or records of the trust or foundation for that respective year must be examined by a well qualified chartered accountant or some other qualified bookkeeper selected as an evaluator of companies. The report and the records of the audit should be filled in Form No. 10B as per Income-charge Rules, 1962 and said review records and report must be equipped along with the return of income.

Must know things before going for Trust Registration

Private Vs Public Trust

In India, Private Trusts are determined and governed by Indian Trusts Act, 1882, whereas public trust controls all its operations and functions by themselves exclude in the state of Maharashtra as Bombay Public Trusts Act, 1950 regulates and governs the functioning and operation of public trusts.

Number of Trustees

There is no definite maximum limit for the number of trustees but at least two trustees are mandatory to file the trust foundation registration. The trust deed should mention all the details and arrangement regarding the administration of the trust along with the strategy and method or procedure which has to be followed for delegating or removing the members

Trust Deed

Trust registration cannot be complete without drafting this important document called a trust deed. It mentions the purpose of the formation of the trust. The document also comprises all the details of its beneficiary and describes the power and rights of trustees. Minimum two witnesses are needed during the trust deed signing process.

Tax Benefit

After completing the registration process, public trusts can avail the exclusive right and benefits offered by the government. Public trusts can also avail the advantage of tax exemption.

Step 5:

Online charitable trust registration certificate is granted. Once your Trust NGO is registration process got completed, you will receive the registered Trust Deed through courier.

Is it mandatory to register a trust?

Registration of a Trust is mandatory from two edges:

It is lawfully not important to have a composed trust deed for the beneficent trust or strict trusts, social activities and organizations. From the hardheaded perspective, nevertheless, it is constantly agreeing for charitable trusts to have a lawfully enlisted trust deed.

Is it mandatory to register a private trust?

Is it mandatory to register a private trust?It is lawfully not important to have a composed trust deed for the beneficent trust or strict trusts, social activities and organizations. From the hardheaded perspective, nevertheless, it is constantly agreeing for charitable trusts to have a lawfully enlisted trust deed.

Is it mandatory to register a private trust?

A private trust which has various property just shouldn’t be registered. Despite, a private trust with firm property should be filed as per the Registration Act, 1908. In this type of trust mostly the family members or individuals are the beneficiaries. A private trust is further classified into two parts:

- Private Trusts in which the recipients and their imperative offers also can be settled

- Private Trusts in which both or either the recipients and their imperative offers can’t be settled

Do I need a consultant for Trust Deed?

Basically, Trust is classified into two categories, Public Trust and Private Trust Public Trust This type of trust is created to furnish benefit to the public in a vast level, therefore the beneficiaries in the type of trust are general public. Public Trust is further classified into two parts:

- Public Charitable Trust

- Public Religious Trust

In this type of trust mostly the family members or individuals are the beneficiaries. A private trust is further classified into two parts:

- Private Trusts in which the recipients and their imperative offers also can be settled

- Private Trusts in which both or either the recipients and their imperative offers can’t be settled

Who can draft a trust deed?

A trust generally includes three parties – a settlor or the creator of the trust, a trustee of the trust and a recipient of the trust. A trust gets commenced when the settlor or the creator transfers any property to the trustee to be utilized and which can be utilized to serve the recipient of the trust.

Choose IVEC, Be Smart.

Access To Experts

We provide access to reliable professionals and coordinate with them to fulfill all your legal requirements. You can also track the progress on our online platform, at all times.

Realistic Expectations

By handling all the paperwork, we ensure a seamless interactive process with the government. We provide clarity on the incorporation process to set realistic expectations.

300-Strong Team

With a team of over 300 experienced business advisors and legal professionals, you are just a phone call away from the best in legal services.

Trusted By Thousand Of People.

Book Your Consultation Now

We’re Trusted By 1000’s Of People Since 2008 🙂 We are a technology-driven platform, offering services that cover the legal needs of startups and established businesses. Some of our services include incorporation, government registrations & filings, accounting, documentation and annual compliances. In addition, we offer a wide range of services to individuals, such as property agreements and tax filings. Our mission is to provide one-click access to individuals and businesses for all their legal and professional needs.

Why Choose IVEC?

No more delays or difficulties! Register your business with India’s #1 provider of company incorporation services. Get a 7 day . Guaranteed document upload to the MCA

Get Set Go!

Our company registration process is completely online, so you don’t even have to leave your home to get your entity registered.