File ITR-6 Easily With IVEC.in

Every business must submit an income tax return using ITR Form 6. Only companies that do not qualify for an exemption under Section 11 must submit ITR Form -6 to the Income Tax Department of India to file their income tax return.

Complete Info About ITR 6

What are the requirements for ITR Form 6 eligibility?

The taxpayers registered as a corporation under the Companies Statute 2013 (or under a previous act) must submit an ITR Form 6. The following taxpayers cannot complete this form:

- Firms\Individuals

- Undivided Hindu Family (HUF)

- Companies claiming exemption under Section 11 and local authorities and artificially

- created judicial person Body of Individuals (BOI) and Association of Persons (AOP)

What is the ITR-6 form’s structure?

The form is divided into two parts, as well as several schedules:

- Part A: Background data

- Balance Sheet as of March 31, 2021, Part A-BS

- Part A-BS-Ind AS: Balance Sheet as of the earlier the date of the business combination or March 31, 2021.

- Manufacturing Account, Part A, for the fiscal year 2020-21

- Trading Account for Fiscal Years 2020-21, Part A

- Part A-P&L: 2020-21 fiscal year profit and loss account

- Manufacturing Account for the fiscal year 2020-21, Part A of the Manufacturing Account-Ind AS.

- Trading Account for the fiscal year 2020-21, Part A of Trading Account Ind-AS.

- For the fiscal year 2020-21, Part A-P&L Ind-AS: Profit and Loss Account is below.

- Other information, Part A-OI

- A-QD: Quantitative information

- Part A-OL: Account for receipts and payments made by a company in liquidation the timetables listed here

- Calculation of total income in Part B-TI.

- Part B-TTI: Calculating the tax owed on the total income

- Taxes paid:

Here are the 42 schedules:

- Schedule-HP: Income under the heading “Income from House Property” computation

- Schedule-BP: Income under “profit and gains from business or profession” computation

- Schedule-DPM: Calculating depreciation on equipment and other assets under the Income Tax Act Schedule-DPM: Summarising depreciation on all purchases under the Income Tax Act Schedule DEP: Calculating deemed capital gains on the sale of depreciable assets

- Deduction under section 35, Schedule ESR (expenditure on scientific research)

- Schedule-CG: Income under the heading of Capital Gains computation.

- Calculate revenue under the heading “Income from other sources” in Schedule-OS.

- Schedule-CYLA: Statement of revenue after deducting losses from the current year

- Schedule-BFLA: Income Statement after offsetting carried-forward, unabsorbed loss from prior years.

- Schedule-CFL includes a statement of losses to be carried forward to subsequent years.

- Details of unabsorbed depreciation and allowance under section 35 are provided in Schedule –UD (4)

- Schedule Income Computation Disclosure Standards’ impact on revenue is known as ICDS.

- Schedule 10AA: Section 10AA deduction computation

- Schedule 80G: Information about donations eligible for section 80G deductions

- Schedule 80GGA: Information on gifts made for rural development or science

- Schedule RA: Information on gifts made to research organisations, etc.

- Schedule 80IA: Section 80IA deduction computation

- Schedule 80IB: Section 80IB deduction computation

- Schedule-80IC or 80IE: Section 80IC or 80 IE deduction computation

- Schedule-VIA: A statement of deductions made under Chapter VIA (from gross income).

- Schedule-SI: Statement of Income Subject to Special Rates of Tax

- Schedule PTI: Pass-through income information from an investment fund or business trust

- Schedule-EI: Income not shown on Statement of Income (exempt incomes)

- Schedule-MAT: Section 115JB’s Minimum Alternate Tax Calculation

- Schedule-MATC: Section 115JAA Tax Credit Calculation

- Schedule BBS: Information about tax on domestic company’s dispersed profits from share buybacks that are not disclosed on the stock exchange

- Secondary adjustment to transfer price per section 92CE, according to Schedule TPSA (2A)

- Schedule TR: Summary of tax relief sought for taxes paid outside India. Schedule FSI: Details of income from outside India and tax relief

- Schedule FA: Information about foreign assets and outside-Indian source income

- Schedule SH-1: Ownership of shares in an unlisted company

- Schedule SH-2: Startups’ Shareholding

- As of the year’s conclusion, assets and liabilities are listed in Schedule AL-1.

- Assets and liabilities as of the year’s conclusion are listed in Schedule AL-2 (applicable for startups only)

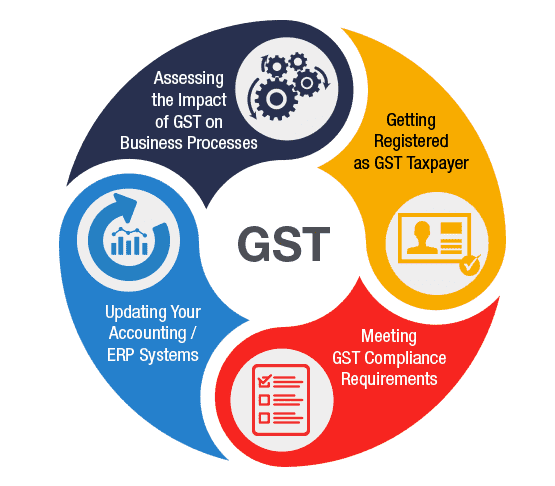

- Information on reported turnover and gross receipts for GST is included in Schedule GST.

- Schedule FD: Break-up of foreign currency payments and receipts

ITR-6 Form: Major Changes

The following is a summary of the significant changes to the ITR-6 Form for AY 2020–21:

- When selling equity shares or units of a business trust subject to STT, a separate schedule 112A must be used to calculate the long-term capital gains.

- The specifics of section 92CE’s levy on secondary adjustments to transfer prices (2A).

- Information on tax deduction requests for purchases, payments, or expenses made between April 1, 2020, and June 30 2020.

ITR Form 6: How Do I Download It?

ITR 6 is free online download at the Income Tax Department’s official website. There are currently no offline options for filing ITR 6 forms.

The actions to take to download ITR 6 online are as follows:

- Step 1: Go to https://www.incometaxindiaefiling.gov.in/home, the official income tax website.

- Step 2: Find the “Download” box in the right sidebar.

- Step 3: Click “ITR Notified Forms AY 2020-21” in step three.

- Step 4: To get ITR 6, click on “ITR 6 Notified Form AY 2020-21.”

How can I submit a Form ITR-6?

This income tax return must be electronically submitted to the Income Tax Department with a digital signature.

Annexes are not necessary.

When filing ITR-6, this return form should not have any attachments, not even the TDS certificate. The IRS advises taxpayers to match their Tax Credit Statement Form 26AS with the taxes deducted, collected, and paid on their behalf.

How should the verification paperwork be filled out?

Complete the Verification paper with the necessary information. Anything irrelevant should be removed.

Before submitting the return, please make sure the verification has been signed.

Select the role or designation of the individual signing the return. Remember that anyone found guilty of making a false statement in return or supporting schedules is subject to prosecution under Section 277 of the Income-tax Act of 1961, which carries a strict prison sentence and a fine.

Frequently Asked Questions

How do I obtain ITR 6?

Visit the Income Tax department’s e-filing portal as the initial step in the online ITR 6 filing process. If you are qualified to file your return using Form 6, choose it. As previously noted, you can complete the form’s fields and electronically sign the verification form when you’ve finished it.

Who ITR 6 Is Not For?

This ITR Form 6 cannot be used by businesses that claim Section 11 exemption for income from property kept for charitable or religious purposes.

Who has access to the ITR 6?

You must fill out the ITR 6 Form’s verification section with the return name, filer’s father’s name, and PAN. Only the managing director of a company has the authority to confirm an income tax return.

How do I do ITR 6 online?

Step 1: After connecting to the e-Filing portal, choose e-File > Income Tax Returns > File Income Tax Return > Select the current AY and Mode of Filing to download the offline utility as an alternative (Offline). Next, select download from the Offline Utility menu.

Where in ITR 6 is the phrase “profit and gain through business or profession”?

Sums that, following Sections 33AB, 33ABA, or 33AC, are considered profits and gains.

How can I submit a new ITR 6 from the portal?

You submit ITR 6 electronically through the income tax department’s e-filing system. You must include information on the audit of the books of accounts together with information about profit and loss, deductions, the balance sheet, and other items.

ITR 6 – Can I file it without DSC?

All businesses required to submit Form ITR-6 returns or businesses, individuals, or HUFs whose accounts must be audited must file their income tax reports electronically using digital signatures.

Can a representative Assessee file my ITR 6?

If a representative Assessee is filing the return, you must first check the appropriate box and provide the following information about him:

- 1) Name

- 2) Capacity

- 3) Address

- 4) PAN

ITR Form filing is required?

Yes, ITR forms with specific information on the taxpayer, their tax liabilities, and eligible deductions must be filled out to file an income tax return.

Benefits Of ITR Filing

Choose IVEC.in

For Top Notch Income Tax Services

Access To Experts

We provide access to reliable professionals and coordinate with them to fulfill all your legal requirements. You can also track the progress on our online platform, at all times.

Realistic Expectations

By handling all the paperwork, we ensure a seamless interactive process with the government. We provide clarity on the incorporation process to set realistic expectations.

300-Strong Team

With a team of over 300 experienced business advisors and legal professionals, you are just a phone call away from the best in legal services.

Trusted By Thousand Of People.

Book Your Consultation Now

We’re Trusted By 1000’s Of People Since 2008 🙂 We are a technology-driven platform, offering services that cover the legal needs of startups and established businesses. Some of our services include incorporation, government registrations & filings, accounting, documentation and annual compliances. In addition, we offer a wide range of services to individuals, such as property agreements and tax filings. Our mission is to provide one-click access to individuals and businesses for all their legal and professional needs.

Why Choose IVEC?

No more delays or difficulties! Register your business with India’s #1 provider of company incorporation services. Get a 7 day . Guaranteed document upload to the MCA

Get Set Go!

Our company registration process is completely online, so you don’t even have to leave your home to get your entity registered.