Every GST Service, Offered

GST Registration Plans Start @ ₹699 Only!

IVEC is the top business accounting & tax consulting services agency , offering end-to-end Income tax and GST services from registration to return filing.

IVEC can help you file GST returns in India. Our promised SLA terms taken to file a GST return is about 1 – 3 working days, Subject to government processing time, client document submission & Sharing of necessary information.

Get a free consultation on GST return filing by scheduling an appointment with IVEC.in

- GST Registration

- GST Return Filing

- GST LUT Filing

- GST Registration Cancellation

- GST Advisory Services

- GST Annual Return Filing

- Call Us : +91 94 35 41 32 37

GST Registration Pricing

-

GST Registration + Compliance Software

-

GST Registration

-

3 Month GST Return Filing

-

Compliance Software

-

GST Registration

-

1 Year GST Return Filing

-

Compliance Software

Insight On Our GST Services

Get advice on Income Tax Filing, GST Tax filing, NRI/ Foreign Tax related & Tax savings. Book your appointment today with ivec.in | Get Tax Expert opinion and Consultation.

GST Registration Online

Apply GST Registration Online in India with Kanakkupillai! As per GST legal process, any business operations or any entity with an annual turnover exceeding Rs 40 lakhs must undergo GST process/procedure in India as a separate taxable provision.

As per GST jurisdiction, any business operations whose annual turnover exceeds Rs 40 lakhs must register as a separate taxable provision. This procedure is called GST registration. It takes around 2-6 working days to obtain the GST registration online in India.

GST Registration Cancellation

The Goods and Service Tax, also called GST, was established on July 1, 2017, to make doing business more accessible and provide individuals with more tax benefits. The government’s new indirect tax policy automates the system by decreasing manual intervention and facilitating a quick procedure. As a result, GST has numerous advantages, and the deletion of the GST Registration number is one such automatic operation. Let’s look at why the GST cancellation process is necessary and how to apply for it.

GST Return Filing

Focus on your Business, leave the procedures and filings to us – IVEC.in. Get easy compliance with the support of CA to online GST return filing. File GST returns online in India without fail as it is a necessary permission/ document needed for every business as per the GST Act/regime to handle their supply and transactions. Steps to file GST in India are controlled by tax authorities to evaluate the tax liability. GST Return Filing in India is a process that acts as a link between the taxpayer and the government.

GST Advisory Services

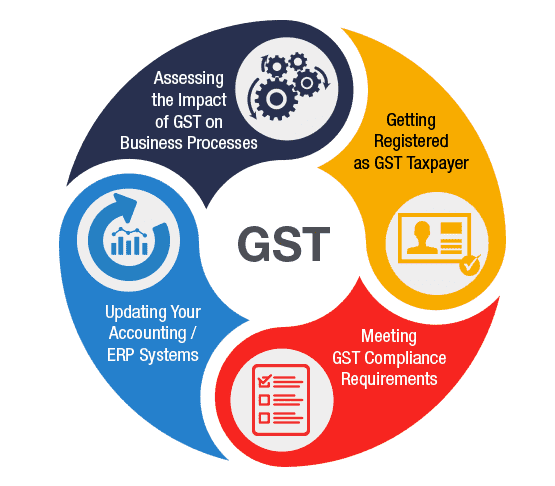

We provide a host of GST advisory services such as covering the impact of GST on the business of clients, examining different market scenarios of business models, legislative business level implementation assistance, transition management and undertaking key compliance.

GST LUT Filing

The letter of undertaking is a document where the user declares that all GST obligations have been met. It is provided if export is made without paying the IGST. Additionally, Notification No. 37 /2017 – Central Tax To export products, services, or both without paying IGST, you must provide LUT. If the exporter does not supply the LUT, he must pay the IGST or post an export bond. Previously, LUTs could only be lodged in person at the appropriate GST office. However, the government has made the LUT filing process more accessible by making it available online.

GST Annual Return Filing

GSTR 9 is an annual tax return that includes information about the supplies you produced and received over the year.

The GSTR 9 is a document or declaration that a registered taxpayer must file once a year. This record will describe all supplies made and received for the year under several tax headings (CGST, SGST, and IGST) and turnover and audit information.

The government has established the GSTR 9C audit form, which taxpayers must file every year with a turnover of more than Rs 2 crore. It’s essentially a reconciliation statement between the taxpayer’s audited yearly financial statements and the annual returns filed in GSTR 9.

Benefits Of GST

Choose IVEC, Be Smart.

Access To Experts

We provide access to reliable professionals and coordinate with them to fulfill all your legal requirements. You can also track the progress on our online platform, at all times.

Realistic Expectations

By handling all the paperwork, we ensure a seamless interactive process with the government. We provide clarity on the incorporation process to set realistic expectations.

300-Strong Team

With a team of over 300 experienced business advisors and legal professionals, you are just a phone call away from the best in legal services.

Trusted By Thousand Of People.

Book Your Consultation Now

We’re Trusted By 1000’s Of People Since 2008 🙂 We are a technology-driven platform, offering services that cover the legal needs of startups and established businesses. Some of our services include incorporation, government registrations & filings, accounting, documentation and annual compliances. In addition, we offer a wide range of services to individuals, such as property agreements and tax filings. Our mission is to provide one-click access to individuals and businesses for all their legal and professional needs.

Why Choose IVEC?

No more delays or difficulties! Register your business with India’s #1 provider of company incorporation services. Get a 7 day . Guaranteed document upload to the MCA

Get Set Go!

Our company registration process is completely online, so you don’t even have to leave your home to get your entity registered.