12AA Registration Online

Apply 12AA Registration Online in India and get an exemption from Income Tax. All income of the affiliation can’t be burdened once this registration process is done. All income of the entity cannot be taxed once after the registration is completed. Form 10A is used to register the 12AA registration process. 12AA Registration helps all NGOs for the exemption on Income Tax for only those who are aware of it. So, be aware and enjoy the benefits out of it.

- Call Us : +91 94 35 41 32 37

Complete Info

12AA registration is done with the plan to get an exemption from Income Tax. All income of the association can’t be burdened once this registration is done. Commissioner of Income-tax department who holds the jurisdiction establishment is capable to deal with your utilization of registration under section 12AA. Form 10A is utilized to fill the application form for 12AA registration. Exemption on Income Tax is accessible for all NGOs however just the individuals who know about it and can remove profit by it. Hence, so as to engage the advantage of exclusion restriction, it is important for all NGOs, Trusts, and other Not-for-Profit organizations to be aware of Section 12AA of Income Tax Act.

Form 10A

Organizations who are happy to get registered under Section 12AA necessities to record form 10A. Associations, for example, Societies, Religious Trusts, Charitable Trusts and Section 8 Companies are qualified to apply for Section 12AA enrollment. 12AA registration procedure along with Form 10A filing has been made web and must be made conceivable with the computerized signature of the signatory.

The fund which you are intending to use for the beneficent or religious purpose will be viewed as salary application. In layman terms, income application is considered as a cost which is brought about by the trust on the good cause or on religious purpose.

The Registration done under Section 12AA is a one time process. Once the registration is done, it stays substantial till the date of cancellation of the registration. 12AA registration shouldn't be restored consequently hence it can be considered as an advantageous profit by the NGOs.

Organizations or individuals who are registered under this section can exploit collection of income which cannot surpass 15% for charitable or religious purposes.

Section 11(2) considers as the application of income subsequently it is excluded from the complete income.

The final income will be absolved from tax.

NGOs enjoy the advantage of accepting numerous licenses from the legislature and different organizations. There are agencies that offer financial support to NGOs and these agencies normally want to make awards to 12AA registered NGOs.

12AA registration applicant needs to submit the following documents along with Form 10A:

Instrument’s self-certified copy which was used in the process of creating trust or establishing the institution shall be submitted.

The foundation or trust may have been made in any case than by method for drafting and registering an instrument. In such cases, a self-attested copy of the document confirming the creation of the trust, or foundation of the institution ought to be submitted to the Income Tax Department.

Provide a self-attested copy of the registration, which was made with the pertinent body. The relevant body might be the Registrar of Companies, the Registrar of Firms and Societies or Registrar of Public Trusts.

A self-certified copy of the document which serves as an evidence at the time of adoption or during alteration of the objective of the entity shall be submitted.

Financial report of the trust/institution for maximum three preceding financial year.

Note on activities which entity perform

There a few cases which may force Income Tax Department to cancel the registration issued under this section. Though once the assessee has resolved the issue he can file for the subsequent application. In such a scenario it is essential for the applicant to submit a self-certified copy of the existing order issuing registration.

In case assessee application has been dismissed, he needs to attach a self-certified copy of the order of rejection with the application.

Eligibility Criteria for obtaining 12AA Registration Online in India

One of the essential standards to get enlistment under Section 12AA is that the reason behind the presence of the association is to accomplish altruistic work as characterized in the Income Tax Act. Indulging in charitable activities incorporate giving education, medical relief to the poor, and performing activities with the rationale to forestall nature.

In the event that the assessee is engaged in activities like exchange or trade, at that point the administrations offered under this segment stays restricted. In such cases, registration is allowed uniquely to those candidates whose receipts from the trade activity are less than twenty percent of the total receipts of the assessee.

Private or Family Trust are not qualified to apply for Section 12AA registration.

Before giving any registration certificate under Section 12AA administrative specialists will check whether there is any benefit thought process engaged with directing the exercises, if not, registration under Section 12AA is allowed.

Registration Procedure for Obtaining 12AA Registration Online in India

Once you have submitted the application in the recommended design accessible online, the Commissioner will request that you present extra reports according to the extra necessities.

he request for additional verification of the documents will help in demonstrating the validity of the activities of the organization.

In the event that the Commissioner is content with the application, then he/she will

register the Trust or Institution under Section 12AA, all the Commissioner should simply pass a solicitation for the enrollment cycle to start.

The provision of Section 12AA(2) states that registering authority shall pass the request for allowing or declining registration before the expiry of a half year from the end of the month in which the application was obtained.

Everything considered 12AA registration is 1 to 3 months length in India. Regardless, when a Trust secures registration, it is genuine for the lifetime of the Trust and there is no need for recharging.

Cancellation of 12AA Registration

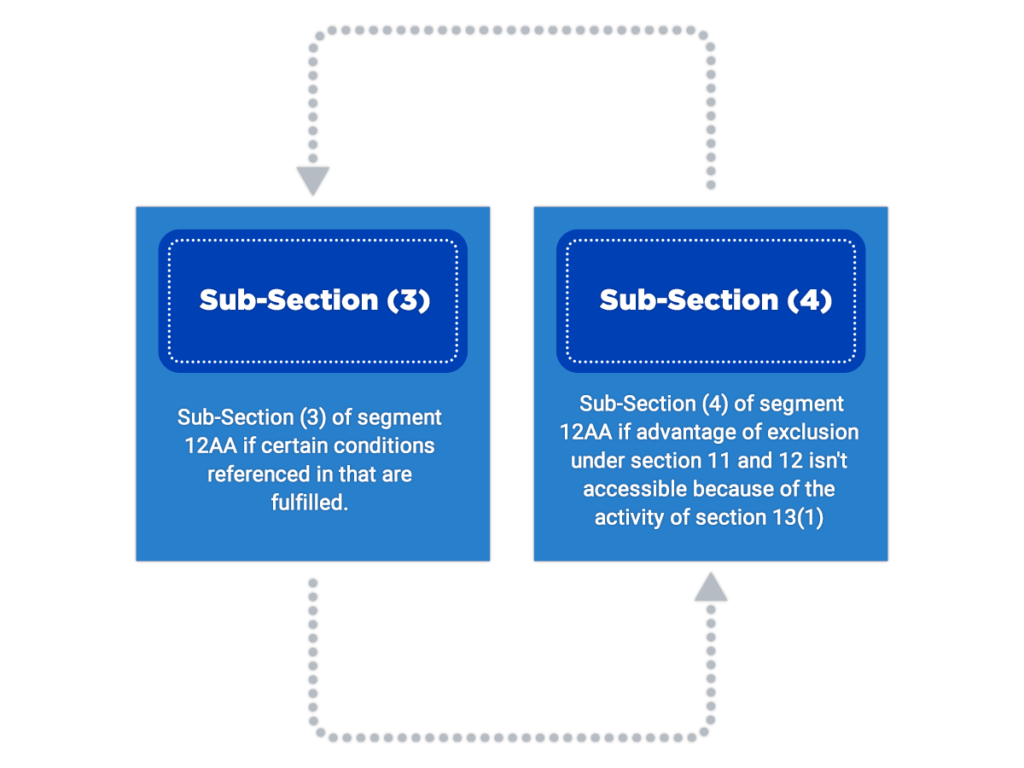

Where a trust or a foundation has been permitted registration under Section 12AA(1)(b) or has gained registration at whatever point under Section 12A as it stayed before the correction by the Finance (No. 2) Act, 1996, the Principal Commissioner or the Commissioner of Income-tax can cancel the registration under the going with two sub-segments:

the activities of a trust or establishment are not genuine, or;

the activities are not being done according to the objects of the trust or establishment.

Cancellation of Registration under Section 12AA (4)

In order to safeguard the arrangements identified with wiping out of enlistment of a trust, area 12AA(4) was inserted to give that where a trust or an establishment has been yielded enlistment, and in this way, it is seen that part 13(1) is material as its exercises are being done in such a manner, that it is for the preferred position of a particularly strict network or station (if it is set up subsequent to start off the Income-charge Act);

Any pay or property of the trust is applied for a bit of leeway of decided individuals like the proprietor of trust, trustees, etc.; or

Its benefits are placed assets into confined modes,

by then the Principal Commissioner or the Commissioner may decide to pass a request recorded as a hard copy expressing the scratch-off of enlistment of such trust or establishment.

What is the difference between 12A and 12AA?

Segment 12A arrangements with the enrollment of trust and Section 12AA arrangements with an online framework for the selection of the trust, Section 8 Company, Society, Trust can look for enlistment under Section 12A of Income Tax Act to guarantee evasion under Income Tax Act’ 1961 if certain conditions are fulfilled.

What is Form 10A?

Associations who are happy to get enlisted under Section 12AA need to document structure 10A. Associations, for example, Section 8 Companies, Societies, Religious Trusts and Charitable Trusts are qualified to apply for Section 12AA enrollment. 12AA enlistment strategy alongside Form 10A documenting has been made on the web and must be made conceivable with the computerized mark of the signatory.

What are the records needed during Section 12AA registration?

Instrument’s self-certified copy which was utilized during the time spent making trust or building up the establishment will be submitted.

A self-affirmed copy of the report which fills in as a proof at the hour of reception or during adjustment of the target of the entry will be submitted.

The foundation or trust may have been presented in any defense than by technique for drafting and registering an instrument.

In such cases, a self-verified duplicate of the record affirming the making of the trust, or establishment of the organization should be submitted to the Income Tax Department.

Financial report of the trust/establishment for the greatest three going before budgetary years.

Note on exercises which substance performs.

Provide a self-attested copy of the registration, which was made with the appropriate body. The applicable body may be the Registrar of Firms, the Registrar of Companies and Societies or Registrar of Public Trusts.

There are a couple of cases which may constrain the Income Tax Department to drop the registration issued under this section. In spite of the fact that once the assessee has settled the issue he can file for the ensuing application. In such a situation it is basic for the candidate to present a self-guaranteed copy of the current request issuing the registration.

In case the assessee has been excused, he needs to append a self-certified copy of the request for dismissal with the application.

Who can guarantee exclusion u/s 11?

The income of a religious trust or establishment is equipped for prohibition, anyway, it may be to help a particular exacting organization or position. The prohibition under Section 11 is available to open severe trusts just and not to trust for private exacting purposes.

What are the benefits of 12AA registration?

The fund which you are intending to use for the beneficent or religious purpose will be viewed as salary application. In layman terms, income application is considered as a cost which is brought about by the trust of the good cause or on religious purpose.

The Registration done under Section 12AA is a one time process. Once the registration is done, it stays substantial till the date of cancellation of the registration. 12AA registration shouldn't be restored consequently hence it can be considered as an advantageous profit by the NGOs.

Organizations or individuals who are registered under this section can exploit collection of income which cannot surpass 15% for charitable or religious purposes.

Section 11(2) considers as the application of income subsequently it is excluded from the complete income.

The final income will be absolved from tax.

NGOs enjoy the advantage of accepting numerous licenses from the legislature and different organizations. There are agencies that offer financial support to NGOs and these agencies normally want to make awards to 12AA registered NGOs.

Is trust an individual under the Income Tax Act?

Trusts fundamentally are not secured under the meaning of individual u/s 2(31) in any case reference of trust can be found u/s 2(15), 10(23C), 11, 12A, 12AA, 13, 115BBC, 115TD to 115TF, 160, 161, 164 and 164A, essentially considering the way that trust is unquestionably not a legitimate component and obligation law wish to use the possibility of operator assessee to trouble the trust.

What is the distinction somewhere in the range of 80G and 12A registration?

In the event that an NGO gets itself enlisted under Section 80G, by then the individual or the affiliation making a gift to the NGO will get an allowance of the half from his/its assessable compensation. In case an NGO gets enrolled under 12AA and 80g, by then just it is material for any organization financing. An as of late enrolled NGO can similarly apply for 80g enlistment.

What is the qualification standard for acquiring 12AA Registration?

One of the essential standards to get enlistment under Section 12AA is that the reason behind the presence of the association is to accomplish altruistic work as characterized in the Income Tax Act. Indulging in charitable activities incorporate giving education, medical relief to the poor, and performing activities with the rationale to forestall nature.

In the event that the assessee is engaged in activities like exchange or trade, at that point the administrations offered under this segment stays restricted. In such cases, registration is allowed uniquely to those candidates whose receipts from the trade activity are less than twenty per cent of the total receipts of the assessee.

Private or Family Trust are not qualified to apply for Section 12AA registration. Before giving any registration certificate under Section 12AA administrative specialists will check whether there is any benefit thought process engaged with directing the exercises, if not, registration under Section 12AA is allowed.

Choose IVEC, Be Smart.

Access To Experts

We provide access to reliable professionals and coordinate with them to fulfill all your legal requirements. You can also track the progress on our online platform, at all times.

Realistic Expectations

By handling all the paperwork, we ensure a seamless interactive process with the government. We provide clarity on the incorporation process to set realistic expectations.

300-Strong Team

With a team of over 300 experienced business advisors and legal professionals, you are just a phone call away from the best in legal services.

Trusted By Thousand Of People.

Book Your Consultation Now

We’re Trusted By 1000’s Of People Since 2008 🙂 We are a technology-driven platform, offering services that cover the legal needs of startups and established businesses. Some of our services include incorporation, government registrations & filings, accounting, documentation and annual compliances. In addition, we offer a wide range of services to individuals, such as property agreements and tax filings. Our mission is to provide one-click access to individuals and businesses for all their legal and professional needs.

Why Choose IVEC?

No more delays or difficulties! Register your business with India’s #1 provider of company incorporation services. Get a 7 day . Guaranteed document upload to the MCA

Get Set Go!

Our company registration process is completely online, so you don’t even have to leave your home to get your entity registered.